Experts call on fintech to expand services outside Java. Experts have called on financial technology (fintech) companies to expand their operations outside of Java and partner with the government to better serve the unbanked population in the country.

A recent survey conducted by the Indonesian Fintech Association (Aftech) among its members revealed that only 23 percent of fintech companies have a reach beyond the island of Java, while 41 percent have operations in Greater Jakarta.

More than half of the respondents, however, said they had set their sights on the unbanked and rural population as a target market.

“The current development in fintech is still concentrated in urban and [suburban] areas. We want to see more financial services made available for people living outside of Java,” said Indonesia National Council for Financial Inclusion project management head Djauhari Sitorus in an online discussion on Thursday.

One of the challenges for reaching clients in rural areas was the low level of digital financial literacy, he added.

More than half of the surveyed fintech firms named low financial literacy as the main challenge in serving the rural market, followed by basic infrastructure problems, such as a lack of internet access in the targeted market and limited capital or resources.

In a 2019 survey by the Financial Services Authority (OJK), the country scored only 38.03 percent on the financial literacy index and 76.19 percent on the financial inclusion index. The government has been pushing for financial inclusion in the country, aiming to score 90 percent on the financial inclusion index by 2024.

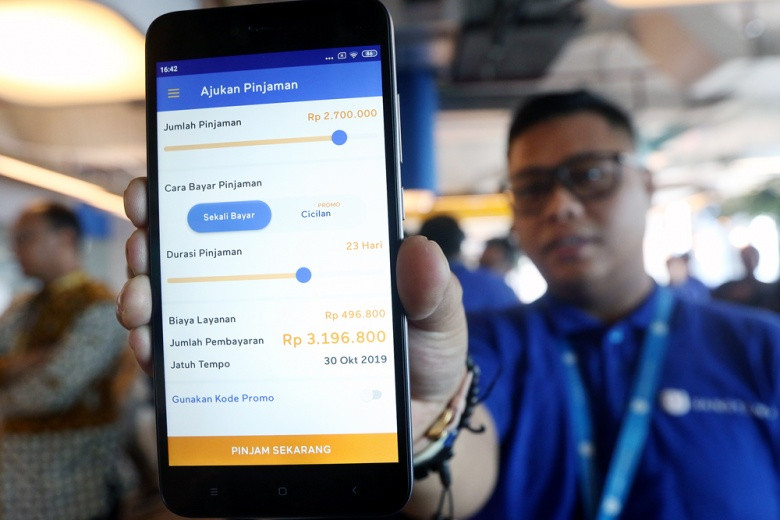

Meanwhile, fintech has been gaining popularity because of its ability to provide financial services to the country’s 93 million underbanked people, according to the 2019 e-Conomy SEA report produced by Google, Temasek and Bain & Company.

“Fintech involvement in the government’s social aid distribution and funds disbursed to small and medium enterprises [SMEs] is still limited and low. There is also much room for improvement for fintech to develop linkage with the banking industry,” Indonesian Banking Development Institute (LPPI) president director Mirza Adityaswara said during the discussion.

He went on to say that fintech platforms were only involved in the government’s pre-employment card program, but none were participating in the Family Hope Program (PKH), the disbursement of village funds or certain other programs.

The Aftech survey revealed that only 23 percent of fintech firms have entered strategic partnerships with the government. The majority of the firms, or 57 percent, have provided consultation for the government on the issue of financial inclusion, 29 percent have joined government social aid disbursement projects and 14 percent have taken part in corporate social responsibility programs.

“I think now it is very timely for the government to trust fintech more, for example, in disbursing micro credit (KUR),” said the OJK’s head of digital financial innovation and micro-finance development, Triyono Gani.

Recently, the Indonesian Fintech Lenders Association (AFPI) offered to help accelerate the disbursement of national economic recovery program (PEN) funds as the government struggles to amass the data needed to deliver the money.

AFPI chairman Adrian Gunadi said in September that the fintech lending industry had a data center and analytic capabilities that could help address the disbursement challenges.

The government has allocated more than Rp123 trillion (US$8.25 billion) of the Rp695.2 trillion COVID-19 response budget to supporting SMEs, the backbone of Indonesia’s economy. However, the government has only spent about 30 percent of the COVID-19 budget, sparking concerns about a prolonged economic recovery.

The panelists on the discussion agreed that fintech could play a role in helping with post-pandemic economic recovery, as the sector remained upbeat despite the global health crisis.

OJK data show that, throughout the first half of the year, the use of electronic money and loan disbursement through peer-to-peer lending steadily increased.

P2P lending platforms disbursed a total of Rp113.5 trillion loans in June, up from Rp88.4 trillion in January despite the COVID-19 situation. “Fintech undoubtedly has the potential to support the national economic recovery as it can reach millions of SMEs,” Aftech chairman Niki Luhur said. “A lot of fintech’s existing infrastructure can also be leveraged to distribute PEN and other government-to-people payments.” Experts call on fintech to expand services outside Java (Eisya A. Eloksari, The Jakarta Post)

Dapatkan Modal Usaha Rp250 juta – Rp2,5 Miliar, Astra Ventura Siap Mencairkan

Dapatkan Modal Usaha Rp250 juta – Rp2,5 Miliar, Astra Ventura Siap Mencairkan