Costly logistics, electricity, labour keep firms from investing in Batam. High costs for logistics and electricity in Batam are burdensome for business, hampering the government’s effort to attract investors to the free trade zone (FTZ) in Riau Islands, business players have said.

Investing in Batam

Abidin Hasibuan, the president director of publicly listed electronics manufacturer PT Sat Nusapersada, said on Thursday that container shipment costs from Batam remained uncompetitive given the poor infrastructure and inefficiency of the area’s main seaport, Batu Ampar Port.

“Shipping containers from Jakarta to Hong Kong is around 50 percent cheaper than from Batam. That doesn’t make sense, as Batam is closer to Hong Kong than Jakarta,” he said during an online discussion held by Media Indonesia.

Furthermore, high electricity and labor costs on the islands also make Batam less competitive than other countries, and that is especially dire for industries relying on exports, according to Abidin.

“We are lucky that the rupiah is still relatively weak compared to the US dollar. If the rupiah strengthens to Rp12,000 per dollar, then we are done,” he said.

The rupiah gained slightly against the US dollar on Monday at Rp14,547, an improvement from its steep depreciation in March at around Rp16,500 per US dollar, the lowest since the 1998 crisis.

The government has taken measures to woo investors with new regulations and tax deals for the Batam FTZ that it expects to aid the region and national economic rebound after the pandemic.

Indonesia’s economy shrank by 5.32 percent year-on-year (yoy) in the second quarter as economic activity fell after the government imposed large-scale social restrictions (PSBB) to curb the spread of COVID-19.

Indonesia’s total investment still grew by 1.8 percent yoy in the first half of 2020 to Rp402.6 trillion (US$27.5 billion), although foreign direct investment (FDI) fell by 8.1 percent yoy over the same period, according to Investment Coordinating Board (BKPM) data.

Meanwhile, the data also showed that the FDI in Riau Islands from January to June this year dipped 15.3 percent yoy to $767.5 million from the same period last year.

Indonesian Chamber of Commerce and Industry (Kadin) Singapore committee chairperson Michael Goutama echoed the sentiment, stating that the government should solve the underlying problems in the Batam FTZ.

Seaport infrastructure development in Batam should be the government’s top priority, followed by human capital development, the electricity cost and social stability in the region, according to Michael.

“Investors see Batam as a promising place to do business. However, we need to solve the underlying issues in the region to lure investment,” he said.

In January, state port operator PT Pelabuhan Indonesia II (Pelindo II) signed an agreement with BP Batam, the authority of the Batam FTZ, to develop Batu Ampar Port, with work slated to begin this year.

The development will see the container stacking area of the port expanded from the current 2 hectares to 12 ha, while the container loading and unloading performance would see an upgrade to 20 containers per hour from an average of 5 containers per hour.

Susiwijono Moegiarso, the secretary of the Office of the Coordinating Economic Minister, said the government was planning to place the FTZ authorities of Batam, Bintan, Tanjung Pinang and Karimun Island—all located in Riau Islands—under a unified council led by the coordinating economic minister, in order to simplify licensing processes.

Bintan, Tanjung Pinang, and Karimun Island’s FTZ authorities are currently under the leadership of the Riau Island governor, unlike BP Batam, which is directly led by the coordinating economic minister, Susiwijono explained.

“We are currently mulling the masterplan for FTZ authorities’ integration. Through the integration, we could reduce the bureaucratic complexity and unify FTZ asset ownership,” he said.

Besides the integration of FTZ authorities, the government is planning to establish six special economic zones (KEK) within the Batam FTZ. It has recently approved the establishment of maintenance, repair and operations (MRO) at the Hang Nadim KEK and the Nongsa Digital Park KEK with estimated investment of Rp6.2 trillion and Rp16 trillion, respectively.

Additional investment incentives, such as 100 percent corporate tax holiday, value added tax (VAT) and luxury tax exemptions for imported goods and import duty deferment for raw materials, will be provided for companies operating inside the KEK, according to Susiwijono.

“We will also allow 100 percent foreign ownership of companies within the enclave [KEK] and apply a zero-percent duty for products with at least 40 percent local content,” he added. Costly logistics, electricity, labour keep firms from investing in Batam (Mardika Parama, The Jakarta Post )

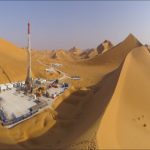

Pertamina Concludes First-Ever Oil Field Development Abroad

Pertamina Concludes First-Ever Oil Field Development Abroad