Thirteen financial institutions get access to government’s civil registry database. Thirteen financial institutions including mobile payment service providers and peer-to-peer lending platforms have been granted access to the government’s civil registry data to expedite data verification as well as to prevent fraud and accelerate financial inclusion.

Civil Registry Database

The institutions signed memorandums of understanding (MoU) with the Home Ministry’s Population and Civil Registration directorate general (Dukcapil) on Thursday that affords the institutions access to civil registry data, including citizenship identification numbers (NIK) and e-ID card (e-KTP) details.

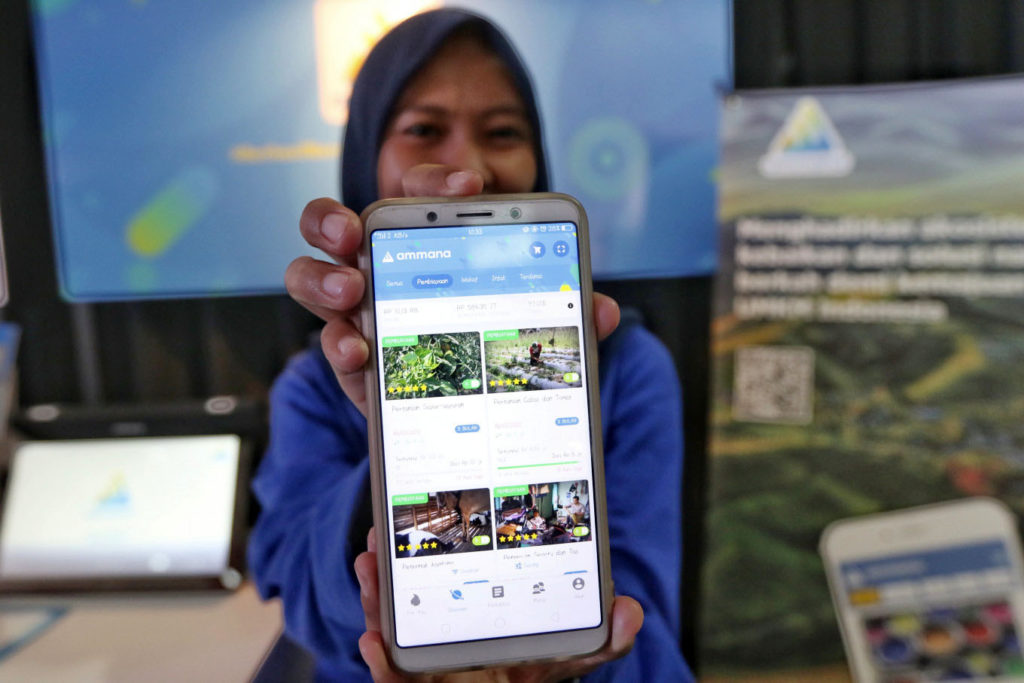

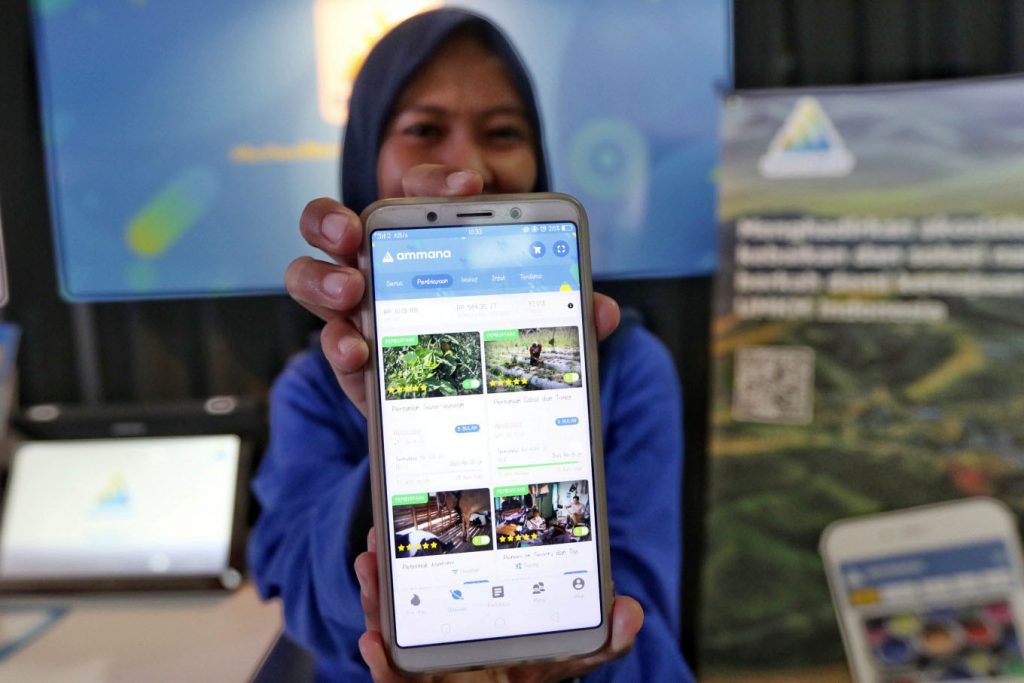

The 13 distribution channels include privately owned Bank Oke Indonesia, financial technology (fintech) peer-to-peer lending companies PT Digital Alpha Indonesia (Uang Teman) and PT Ammana Fintek Syariah, e-wallet OVO, multifinance firm PT Astrido Pasific Finance and foundation Yayasan Dompet Dhuafa Republika.

“We want to give our support, so that the tasks and the purpose of your organizations can run smoothly by fast verification through access to Dukcapil’s data,” Home Minister Tito Karnavian said during a live-streamed signing event on Thursday.

He added that, not only would the agreement allow for more efficient processes, it could also prevent possible fraud, as users of these 13 platforms would need to be verified against Dukcapil’s database before being granted loans or financing.

According to Home Affairs Ministry data, as many as 2,108 other institutions have signed the same agreement. Banks account for more than half of that figure, followed by higher education institutions.

“We have to be able to utilize data in ways that comply not only with the rule of law but also the privacy rights of the Indonesian people,” Tito stressed.

Dukcapil Director General Zudan Arif Fakrulloh emphasized that, in line with the principle of data privacy, the partnership only authorized access to requested data in order for the user-institutions to conduct cross-verification and did not grant access to Dukcapil’s entire database.

The institutions also have to fulfil several legality aspects as well as obtain a recommendation from the authority of their respective field, such as the Financial Services Authority (OJK), before getting the access.

Prior to the agreement, the institutions said parts of their verification process were still done manually, or that they partnered with third parties to help them verify users’ data.

Sharia peer-to-peer (P2P) lending platform Ammana Fintek Syariah founder and CEO Lutfi Adhiansyah told reporters during a press conference following the MoU signing that the agreement enabled the company to compare data that it had already gathered to quickly complete its Know Your Customer (KYC) process.

“The verification with Dukcapil’s database will only be done with our users’ consent,” he said, adding that the company had already obtained security data management certification as one of the requirements to get a recommendation from the OJK.

Financial services provider Pendanaan co-founder and CEO Dino Martin, who is also the representative of the Indonesian Fintech Lenders Association (AFPI), added that the partnership would increase the company’s ability to pursue its financial inclusion agenda, as it assisted the process of digital onboarding and expanded access when the company’s reach was limited due to the ongoing pandemic.

“This partnership is also a response to welcome the new normal, in which people are now closer to the digital world in many aspects, including the financial aspect,” P2P lending startup Uang Teman CEO Aidil Zulkifli said during the live-streamed press conference on Thursday. Thirteen financial institutions get access to government’s civil registry database (Yunindita Prasidya, The Jakarta Post)

Merawat Pinggul dan Sendi Lutut dengan Telemedis, Hindari Operasi

Merawat Pinggul dan Sendi Lutut dengan Telemedis, Hindari Operasi